Tomorrow’s banking – Driven by data analytics

September 14, 2024

The global financial sector has seen unprecedented change over the past few years, and it will surely have a niche in the future. Every quarter brings new laws and regulations that can affect businesses. So, in this dynamic environment, a seamless customer experience is the key. For banks, it is necessary to understand who the high-value customers are. Which customers have the highest potential? Which area is generating the highest value?

However, in this agile business environment, rapidly increasing data is considered an asset for banking leaders around the world to answer and target desired customers. So, how do you make sense of all the data in banks? “Banking analytics” is the answer.

Banking analytics 101

Organizations can leverage data analytics to do everything, from finding out more information about their customers' preferences to improvising their daily operations, performing predictive modelling, and forecasting growth opportunities. Banks can grasp enormous potential by establishing modern analytics as a true business partner. Banking analytics may refer to the use of analytics, AI/ML and BI techniques applied to customer data to make informed business decisions.

Why are banking analytics required for today’s banking

Harnessing value from data isn’t a new concept in the BSFI domain. In fact, the industry is widely considered to be the pioneer in the adoption of modern analytics and business intelligence practices

How banks of the future leveraging data analytics

Many financial institutions have already integrated an analytics environment with an analytics-first culture, and some are still struggling. Today’s challenging environment demands a 360-degree analytics integration rather than a few business lines.

Growth accelerator

Deeper and more detailed customer profiles clubbed with transactional and trading analytics can improve the acquisition and retention of clients. Also, it provides more cross-sell and upsell opportunities. For example, a bank uses credit-card transactional data to develop offers that give customers more attractive incentives to make regular purchases. The data can be collected from both sides (banks and merchants), which boosts the banks’ commission and provides more value to customers.

Heightened productivity

Banks can leverage advanced analytics to provide a faster and more accurate response to compliance and regulatory requests. One of the industry leaders leveraged artificial intelligence and machine learning to understand the characteristics of code, running time, and cost analysis. Further reducing the cost by 15% a bank used analytics to update its cash requirement at every ATM across the country, combined with other optimizations for businesses.

Enhanced digital banking

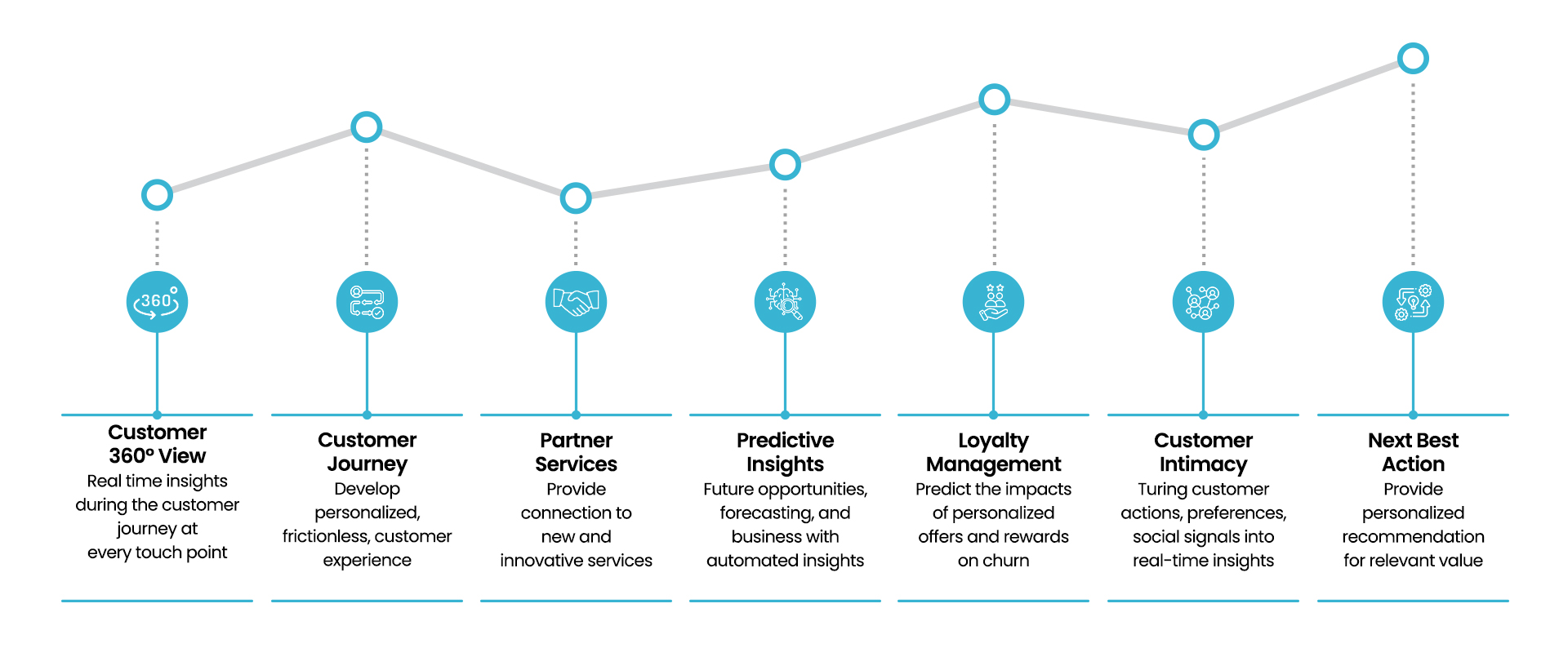

Another faucet where modern analytics are having a strong impact globally is the transformation it carried for digital banks. For digital banks and services, modern big data architectures provide much better customer experiences at a fraction of the cost of traditional banking. Moreover, in some regions, up to 65% of customers are now utilizing digital banking via multiple channels. Digital banks strive to deliver seamless customer service at every touch point by gathering real-time data to understand the prospective customer journey.

Data and Banking Analytics for the Future

Finally, a solid data foundation with a robust business intelligence landscape can help the bank find a new source of growth and potential business opportunities. Banks, as a data-oriented organization, sit at the centre of consumer preference ecosystems and can give leads in both B2C and B2B businesses. Updating data architecture delivers 360-degree customer insights, a personalized customer experience, operational cost and excellence, risk mitigation, and many other competitive advantages.

Furthermore, BFSI can leverage domains like credit risk modelling, risk analysis and monitoring, fraud detection, customer lifetime value, and product recommendation engine management. Thinking about taking the first step towards using intuitive self-services and business analytics tools? Or are you looking for core banking improvisations, visit our page here for management and data analytics services anytime and see how we are solving complex data-driven challenges for success.

Quick Link

You may like

Factoring in change by revolutionizing the manufacturing industry through data analytics

Ultimate game-changer and manufacturing analytics is a catalyst for industry revolution 4.0

READ MOREHow can we help you?

Are you ready to push boundaries and explore new frontiers of innovation?